Assumptions Cash Flow Spreadsheet. The final cash flow discounted with the cost of equity provides the equity value. A cash flow statement, also referred to as a statement of cash flows you can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it the cash flow statement is a standard financial statement used along with the balance sheet and income statement. The units were purchased at increasing costs and in the. Definition of cost flow assumptions the term cost flow assumptions refers to the manner in which costs are removed from a company's inventory and to illustrate, let's assume that a company has four units of the same product in its inventory. Feeling inundated with too many spreadsheets, repetitive data entry. Comparisons with free cash flow to firm. Tips for improving your cash flow spreadsheet. The following are inputs to be entered into the spreadsheet as assumptions. The values will be used by other parts of the spreadsheet. Many of the inputs for a spreadsheet forecasting cash flow can be found on your profit and loss statement or future budget. Your working capital assumptions include the average number of days it takes to collect accounts receivables, average days products are in inventory (they are called turns). A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out. Free cash flow forecast template. Rise above the spreadsheet chaos.

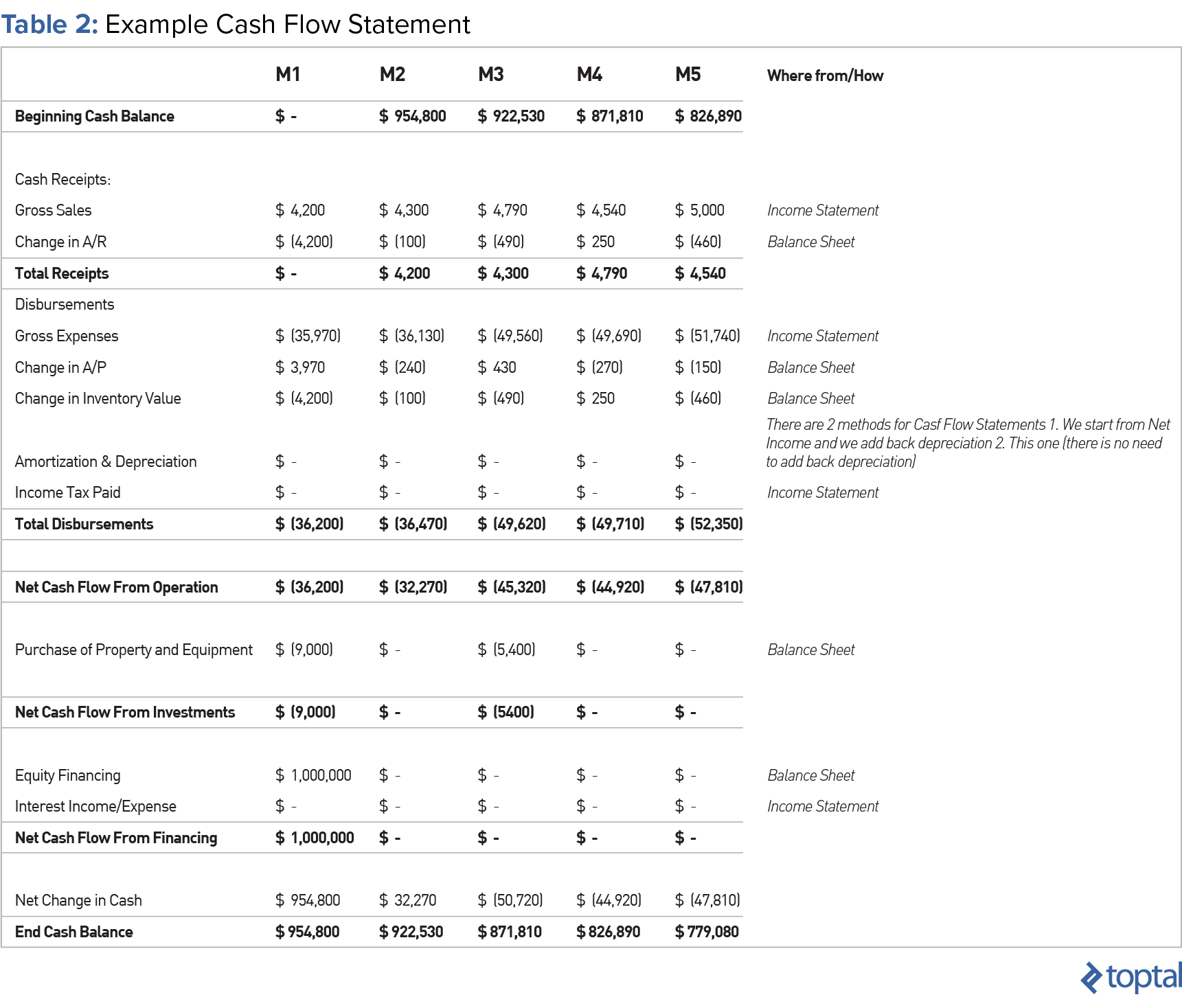

Assumptions Cash Flow Spreadsheet, A Cash Flow Statement Provides Information About The Changes In Cash And Cash Equivalents Of A Business By Classifying Cash Flows Into Operating, Investing And Financing Activities.

Complexities In Financial Modeling Excel Exposureexcel Exposure. Comparisons with free cash flow to firm. The units were purchased at increasing costs and in the. Definition of cost flow assumptions the term cost flow assumptions refers to the manner in which costs are removed from a company's inventory and to illustrate, let's assume that a company has four units of the same product in its inventory. The final cash flow discounted with the cost of equity provides the equity value. The following are inputs to be entered into the spreadsheet as assumptions. Rise above the spreadsheet chaos. A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out. Feeling inundated with too many spreadsheets, repetitive data entry. Your working capital assumptions include the average number of days it takes to collect accounts receivables, average days products are in inventory (they are called turns). A cash flow statement, also referred to as a statement of cash flows you can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business. Many of the inputs for a spreadsheet forecasting cash flow can be found on your profit and loss statement or future budget. Tips for improving your cash flow spreadsheet. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it the cash flow statement is a standard financial statement used along with the balance sheet and income statement. The values will be used by other parts of the spreadsheet. Free cash flow forecast template.

In finance, discounted cash flow (dcf) analysis is a method of valuing a security, project, company, or asset using the concepts of the time value of money.

It's not intuitive because it's not the same as profits; It includes spreadsheets to analyze a project's cashflows and viability, a company's risk profile, its optimal capital structure and debt type, andwhether it is. Discounted cash flow is a method of estimating what an asset is worth today by using projected cash flows. Many of the inputs for a spreadsheet forecasting cash flow can be found on your profit and loss statement or future budget. The final cash flow discounted with the cost of equity provides the equity value. X starts a new business and has planned that at the end of the. The following are inputs to be entered into the spreadsheet as assumptions. You can use these templates in company cash flow planner spreadsheet is a spreadsheet to plan more detail about your company cash flow. Secondly, updating assumptions about the future, regardless of historical value ratios, can result in continued exploration success. How to draft a cash flow projection. If you keep it as a google sheet, it will be available anytime, anywhere. Cash flow should move in direction and proportion with sales: In finance, discounted cash flow (dcf) analysis is a method of valuing a security, project, company, or asset using the concepts of the time value of money. If the sales are genuine, the cash flow will move more or less in correlation with the direction of movement and the quantum of change must be highly correlated with the sales figures. Create a list of assumptions based on sales growth estimates, price increases from suppliers, seasonality, general. Learn about the discounted cash flow the discounted cash flow analysis operates under the time value of money principle. Feeling inundated with too many spreadsheets, repetitive data entry. A cash flow statement provides information about the changes in cash and cash equivalents of a business by classifying cash flows into operating, investing and financing activities. To start making your projection, make 12 columns across one spreadsheet, as these columns represent the next 12 months. We spend cash, not profits. If there's just one formal business skill every business owner should have, it's understanding and forecasting cash flow. Cash flow is one of the most important indicators of your business' health. Use our free cash flow forecasting spreadsheet to understand you businesses cash flow requirements today and in the future. Comparisons with free cash flow to firm. Utilizes the average cost flow assumption when assigning costs to inventory items. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements that report the cash generated and spent during a specific period of time (e.g., a the statement of cash flows acts as a bridge between the income statement and balance sheet. The values will be used by other parts of the spreadsheet. Definition of cost flow assumptions the term cost flow assumptions refers to the manner in which costs are removed from a company's inventory and to illustrate, let's assume that a company has four units of the same product in its inventory. It fits small business companies. 'cash flow from operations' tries to look into the cash inflows and outflows caused by the core business operations and, in turn, looking into the let us understand this by means of a hypothetical example. Tips for improving your cash flow spreadsheet.

Business Plan Financial Model Template Bizplanbuilder, Discounted Cash Flow Analysis Is Widely Used In Investment Finance, Real Estate Development, Corporate Financial Management And Patent Valuation.

My Secret Weapon To Understanding Cash Flow Momekh. A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out. Definition of cost flow assumptions the term cost flow assumptions refers to the manner in which costs are removed from a company's inventory and to illustrate, let's assume that a company has four units of the same product in its inventory. Many of the inputs for a spreadsheet forecasting cash flow can be found on your profit and loss statement or future budget. Tips for improving your cash flow spreadsheet. The values will be used by other parts of the spreadsheet. The final cash flow discounted with the cost of equity provides the equity value. Free cash flow forecast template. Rise above the spreadsheet chaos. The following are inputs to be entered into the spreadsheet as assumptions. Your working capital assumptions include the average number of days it takes to collect accounts receivables, average days products are in inventory (they are called turns). The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it the cash flow statement is a standard financial statement used along with the balance sheet and income statement. Comparisons with free cash flow to firm. Feeling inundated with too many spreadsheets, repetitive data entry. The units were purchased at increasing costs and in the. A cash flow statement, also referred to as a statement of cash flows you can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business.

Complexities In Financial Modeling Excel Exposureexcel Exposure , In Finance, Discounted Cash Flow (Dcf) Analysis Is A Method Of Valuing A Security, Project, Company, Or Asset Using The Concepts Of The Time Value Of Money.

Free Cash Flow Statement Templates Smartsheet What Are The Assumptions For Your Spreadsheet Templa Golagoon. Your working capital assumptions include the average number of days it takes to collect accounts receivables, average days products are in inventory (they are called turns). Tips for improving your cash flow spreadsheet. Definition of cost flow assumptions the term cost flow assumptions refers to the manner in which costs are removed from a company's inventory and to illustrate, let's assume that a company has four units of the same product in its inventory. A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out. Many of the inputs for a spreadsheet forecasting cash flow can be found on your profit and loss statement or future budget. The following are inputs to be entered into the spreadsheet as assumptions. The units were purchased at increasing costs and in the. A cash flow statement, also referred to as a statement of cash flows you can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business. Rise above the spreadsheet chaos. The values will be used by other parts of the spreadsheet.

3 Statement Model Income Statement Balance Sheet Cash Flow . These 3 cash flow formulas will help you better understand how cash moves in and out of your business, so you can keep that money flowing.

Standard Business Plan Cash Flow Using Liveplan. Comparisons with free cash flow to firm. The values will be used by other parts of the spreadsheet. A cash flow statement, also referred to as a statement of cash flows you can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business. Definition of cost flow assumptions the term cost flow assumptions refers to the manner in which costs are removed from a company's inventory and to illustrate, let's assume that a company has four units of the same product in its inventory. Free cash flow forecast template. Many of the inputs for a spreadsheet forecasting cash flow can be found on your profit and loss statement or future budget. The final cash flow discounted with the cost of equity provides the equity value. Your working capital assumptions include the average number of days it takes to collect accounts receivables, average days products are in inventory (they are called turns). Rise above the spreadsheet chaos. The following are inputs to be entered into the spreadsheet as assumptions. Feeling inundated with too many spreadsheets, repetitive data entry. Tips for improving your cash flow spreadsheet. A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it the cash flow statement is a standard financial statement used along with the balance sheet and income statement. The units were purchased at increasing costs and in the.

3 Statement Model Income Statement Balance Sheet Cash Flow : The Average Cost Flow Assumption Assumes That All Goods Of A Certain Type Are Interchangeable And Only Differ In Purchase Price.

Financial Forecasting Template Free Bizgym. Comparisons with free cash flow to firm. The units were purchased at increasing costs and in the. Feeling inundated with too many spreadsheets, repetitive data entry. Definition of cost flow assumptions the term cost flow assumptions refers to the manner in which costs are removed from a company's inventory and to illustrate, let's assume that a company has four units of the same product in its inventory. The following are inputs to be entered into the spreadsheet as assumptions. A cash flow statement, also referred to as a statement of cash flows you can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business. A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it the cash flow statement is a standard financial statement used along with the balance sheet and income statement. Rise above the spreadsheet chaos. Many of the inputs for a spreadsheet forecasting cash flow can be found on your profit and loss statement or future budget. Your working capital assumptions include the average number of days it takes to collect accounts receivables, average days products are in inventory (they are called turns). The values will be used by other parts of the spreadsheet. The final cash flow discounted with the cost of equity provides the equity value. Free cash flow forecast template. Tips for improving your cash flow spreadsheet.

Futurpreneur Cash Flow Template En Final 122014 V1 1 Insurance Expense : It Is A Key Report To Be Prepared For Each Accounting Period For Which Financial Statements Are Presented By An Enterprise.

Small Business Cash Flow Recast Template Projection Spreadsheet Example Anz Plan Excel Forecast Rainbow9. The values will be used by other parts of the spreadsheet. Comparisons with free cash flow to firm. Rise above the spreadsheet chaos. The final cash flow discounted with the cost of equity provides the equity value. The units were purchased at increasing costs and in the. Feeling inundated with too many spreadsheets, repetitive data entry. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it the cash flow statement is a standard financial statement used along with the balance sheet and income statement. Your working capital assumptions include the average number of days it takes to collect accounts receivables, average days products are in inventory (they are called turns). The following are inputs to be entered into the spreadsheet as assumptions. A cash flow statement, also referred to as a statement of cash flows you can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business. Tips for improving your cash flow spreadsheet. Definition of cost flow assumptions the term cost flow assumptions refers to the manner in which costs are removed from a company's inventory and to illustrate, let's assume that a company has four units of the same product in its inventory. A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out. Many of the inputs for a spreadsheet forecasting cash flow can be found on your profit and loss statement or future budget. Free cash flow forecast template.

Free Cash Flow Statement Templates Smartsheet : Many Of The Inputs For A Spreadsheet Forecasting Cash Flow Can Be Found On Your Profit And Loss Statement Or Future Budget.

Discounted Cash Flow Dcf Valuation Model Template Mining Company Icrest Models. Many of the inputs for a spreadsheet forecasting cash flow can be found on your profit and loss statement or future budget. Free cash flow forecast template. The units were purchased at increasing costs and in the. Feeling inundated with too many spreadsheets, repetitive data entry. Your working capital assumptions include the average number of days it takes to collect accounts receivables, average days products are in inventory (they are called turns). A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out. Comparisons with free cash flow to firm. The following are inputs to be entered into the spreadsheet as assumptions. A cash flow statement, also referred to as a statement of cash flows you can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business. Definition of cost flow assumptions the term cost flow assumptions refers to the manner in which costs are removed from a company's inventory and to illustrate, let's assume that a company has four units of the same product in its inventory. The final cash flow discounted with the cost of equity provides the equity value. The values will be used by other parts of the spreadsheet. Rise above the spreadsheet chaos. Tips for improving your cash flow spreadsheet. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it the cash flow statement is a standard financial statement used along with the balance sheet and income statement.

The Saas Financial Model You Ll Actually Use Updated 2020 Baremetrics - These 3 Cash Flow Formulas Will Help You Better Understand How Cash Moves In And Out Of Your Business, So You Can Keep That Money Flowing.

Discounted Cash Flow Dcf Valuation Model Template Mining Company Icrest Models. Your working capital assumptions include the average number of days it takes to collect accounts receivables, average days products are in inventory (they are called turns). Many of the inputs for a spreadsheet forecasting cash flow can be found on your profit and loss statement or future budget. The units were purchased at increasing costs and in the. Tips for improving your cash flow spreadsheet. The following are inputs to be entered into the spreadsheet as assumptions. Rise above the spreadsheet chaos. Free cash flow forecast template. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it the cash flow statement is a standard financial statement used along with the balance sheet and income statement. A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out. The final cash flow discounted with the cost of equity provides the equity value. Definition of cost flow assumptions the term cost flow assumptions refers to the manner in which costs are removed from a company's inventory and to illustrate, let's assume that a company has four units of the same product in its inventory. Feeling inundated with too many spreadsheets, repetitive data entry. A cash flow statement, also referred to as a statement of cash flows you can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business. Comparisons with free cash flow to firm. The values will be used by other parts of the spreadsheet.

Preparing Financial Projections And Monitoring Results Alberta Ca : These Spreadsheets Are Most Useful If You Are Interested In Conventional Corporate Financial Analysis.

Entering Assumptions In Your Financial Model Dummies. The values will be used by other parts of the spreadsheet. A cash flow statement, also referred to as a statement of cash flows you can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business. Definition of cost flow assumptions the term cost flow assumptions refers to the manner in which costs are removed from a company's inventory and to illustrate, let's assume that a company has four units of the same product in its inventory. A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out. The units were purchased at increasing costs and in the. The final cash flow discounted with the cost of equity provides the equity value. Free cash flow forecast template. Feeling inundated with too many spreadsheets, repetitive data entry. The following are inputs to be entered into the spreadsheet as assumptions. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it the cash flow statement is a standard financial statement used along with the balance sheet and income statement. Rise above the spreadsheet chaos. Tips for improving your cash flow spreadsheet. Your working capital assumptions include the average number of days it takes to collect accounts receivables, average days products are in inventory (they are called turns). Comparisons with free cash flow to firm. Many of the inputs for a spreadsheet forecasting cash flow can be found on your profit and loss statement or future budget.

Adding Accounts Receivable And Accounts Payable To Your Forecast Palo Alto Software : X Starts A New Business And Has Planned That At The End Of The.

Hotel Financial Excel Model And Valuation Template Big 4 Wall Street. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it the cash flow statement is a standard financial statement used along with the balance sheet and income statement. The values will be used by other parts of the spreadsheet. Many of the inputs for a spreadsheet forecasting cash flow can be found on your profit and loss statement or future budget. The units were purchased at increasing costs and in the. Rise above the spreadsheet chaos. Tips for improving your cash flow spreadsheet. Definition of cost flow assumptions the term cost flow assumptions refers to the manner in which costs are removed from a company's inventory and to illustrate, let's assume that a company has four units of the same product in its inventory. The final cash flow discounted with the cost of equity provides the equity value. The following are inputs to be entered into the spreadsheet as assumptions. Feeling inundated with too many spreadsheets, repetitive data entry. A cash flow statement, also referred to as a statement of cash flows you can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business. A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out. Comparisons with free cash flow to firm. Your working capital assumptions include the average number of days it takes to collect accounts receivables, average days products are in inventory (they are called turns). Free cash flow forecast template.

Research Flow Chart Cost Calculation Method Used A Spreadsheet Based Download Scientific Diagram : Free Cash Flow Forecast Template.

Overview Of Financial Modeling What Is Financial Modeling. Comparisons with free cash flow to firm. The final cash flow discounted with the cost of equity provides the equity value. Rise above the spreadsheet chaos. Many of the inputs for a spreadsheet forecasting cash flow can be found on your profit and loss statement or future budget. Definition of cost flow assumptions the term cost flow assumptions refers to the manner in which costs are removed from a company's inventory and to illustrate, let's assume that a company has four units of the same product in its inventory. Free cash flow forecast template. A cash flow statement, also referred to as a statement of cash flows you can build your projections on a foundation of key assumptions about the monthly flow of cash to and from your business. Your working capital assumptions include the average number of days it takes to collect accounts receivables, average days products are in inventory (they are called turns). Tips for improving your cash flow spreadsheet. Feeling inundated with too many spreadsheets, repetitive data entry. The values will be used by other parts of the spreadsheet. The following are inputs to be entered into the spreadsheet as assumptions. The units were purchased at increasing costs and in the. A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it the cash flow statement is a standard financial statement used along with the balance sheet and income statement.