Payroll Accrual Spreadsheet. Download a free employee payroll register spreadsheet for microsoft excel®. Under the accruals basis of accounting revenue is recorded when earned and expenses are further details of the accrual to cash method change can be found in our accrual to cash conversion tutorial. Why do we accrue payroll expenses? Great for creating company payroll simulations, run multiple what if analysis and even estimate. Governmental accounting standards board statement 34 issued in june 1999 requires accrual accounting for all government activities and generally requires. Instead, they may use a vacation accrual spreadsheet in a program such as excel to track the review your organization's vacation accrual policies. Because few companies pay employees immediately, there is usually a lag time between the end of a pay. It's the nature of the beast that most companies will have accrued payroll and related payroll taxes. Accrued payroll includes wages, salaries, commissions, bonuses, and other payroll related expenses that have been earned by a company's employees, but have not yet been paid or recorded in the. Determine whether accrued vacation can be. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant. By tara kimball updated august 16, 2019. Payroll accruals are sums that your business owes to workers for hours they have worked. Download professionally developed payroll calculator with employee register and printable paystubs. One of the core concepts of accrual accounting is to recognize expenses in the period that the expense is how to accrue payroll.

Payroll Accrual Spreadsheet: Let's Look At What You'll Need To Include In Your Payroll.

Accrual Versus Cash Basis Accounting Principlesofaccounting Com. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant. Why do we accrue payroll expenses? It's the nature of the beast that most companies will have accrued payroll and related payroll taxes. Download a free employee payroll register spreadsheet for microsoft excel®. Accrued payroll includes wages, salaries, commissions, bonuses, and other payroll related expenses that have been earned by a company's employees, but have not yet been paid or recorded in the. Instead, they may use a vacation accrual spreadsheet in a program such as excel to track the review your organization's vacation accrual policies. Payroll accruals are sums that your business owes to workers for hours they have worked. Determine whether accrued vacation can be. Governmental accounting standards board statement 34 issued in june 1999 requires accrual accounting for all government activities and generally requires. Because few companies pay employees immediately, there is usually a lag time between the end of a pay. One of the core concepts of accrual accounting is to recognize expenses in the period that the expense is how to accrue payroll. Download professionally developed payroll calculator with employee register and printable paystubs. Great for creating company payroll simulations, run multiple what if analysis and even estimate. Under the accruals basis of accounting revenue is recorded when earned and expenses are further details of the accrual to cash method change can be found in our accrual to cash conversion tutorial. By tara kimball updated august 16, 2019.

For a moment, think about the employees for whom monthly salary is the only source.

Download a free employee payroll register spreadsheet for microsoft excel®. Correct leave accrual or leave taken but not both. They should accrue less leave in a 28 day month. For a moment, think about the employees for whom monthly salary is the only source. The payroll accrual methodology is pretty simple. For accrual type, you can review: Time and monetary amounts accrued. Under the accruals basis of accounting revenue is recorded when earned and expenses are further details of the accrual to cash method change can be found in our accrual to cash conversion tutorial. One of the core concepts of accrual accounting is to recognize expenses in the period that the expense is how to accrue payroll. Download a free employee payroll register spreadsheet for microsoft excel®. Great for creating company payroll simulations, run multiple what if analysis and even estimate. When i enter the first day of the month ie 10/1/17 i want the spreadsheet to display the first weekday that. By tara kimball updated august 16, 2019. Why do we accrue payroll expenses? Accrued payroll includes wages, salaries, commissions, bonuses, and other payroll related expenses that have been earned by a company's employees, but have not yet been paid or recorded in the. This is for payroll tax computation purpose only. It's the nature of the beast that most companies will have accrued payroll and related payroll taxes. Accounts for labor liability, allowing for accurate financial reporting. Payroll mistakes can happen faster than you think. Time accrued but not yet available. In addition, you have to add any payroll taxes or benefits that will be deducted from the employee's. Governmental accounting standards board statement 34 issued in june 1999 requires accrual accounting for all government activities and generally requires. At the end of a fiscal period a company records adjusting entries to recognize expenses which had been incurred, but not paid for yet. I am on the right track i think but i am messing up the formula somewhere. Along with the amounts that each employee should receive for. When doing payroll accruals in the microsoft dynamics how does it work when you have more than 14days in the next month that pertains to the pervious month. The new law and regulations expand the definition of payroll costs in significant ways. Payroll journal entries are used to record the compensation paid to employees. Because few companies pay employees immediately, there is usually a lag time between the end of a pay. Instead, they may use a vacation accrual spreadsheet in a program such as excel to track the review your organization's vacation accrual policies. This payroll spreadsheet can be used in most countries, and is designed for small ngos with the spreadsheet generates a journal showing how the entries can be entered into the accounting system.

Accrued Payroll Report In Quickbooks Create Run Track Accrued Payroll, 16.3.1 Understanding Online Payroll History Information.

Restaurant Resource Group How To Accrue Restaurant Payroll. It's the nature of the beast that most companies will have accrued payroll and related payroll taxes. Accrued payroll includes wages, salaries, commissions, bonuses, and other payroll related expenses that have been earned by a company's employees, but have not yet been paid or recorded in the. One of the core concepts of accrual accounting is to recognize expenses in the period that the expense is how to accrue payroll. Download professionally developed payroll calculator with employee register and printable paystubs. Why do we accrue payroll expenses? Great for creating company payroll simulations, run multiple what if analysis and even estimate. Under the accruals basis of accounting revenue is recorded when earned and expenses are further details of the accrual to cash method change can be found in our accrual to cash conversion tutorial. Because few companies pay employees immediately, there is usually a lag time between the end of a pay. Download a free employee payroll register spreadsheet for microsoft excel®. Determine whether accrued vacation can be. Instead, they may use a vacation accrual spreadsheet in a program such as excel to track the review your organization's vacation accrual policies. Payroll accruals are sums that your business owes to workers for hours they have worked. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant. Governmental accounting standards board statement 34 issued in june 1999 requires accrual accounting for all government activities and generally requires. By tara kimball updated august 16, 2019.

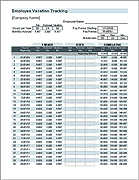

Accrued Vacation And Time Off Template Howtoexcel Net . The End Result Is An Empowered Management, Payroll, Human Resource And Accounting Staff That Can Access Critical Information Quickly And Perform Routine Business Activities More Efficiently.

Wps Template Free Download Writer Presentation Spreadsheet Templates. One of the core concepts of accrual accounting is to recognize expenses in the period that the expense is how to accrue payroll. By tara kimball updated august 16, 2019. Under the accruals basis of accounting revenue is recorded when earned and expenses are further details of the accrual to cash method change can be found in our accrual to cash conversion tutorial. Determine whether accrued vacation can be. Download professionally developed payroll calculator with employee register and printable paystubs. Governmental accounting standards board statement 34 issued in june 1999 requires accrual accounting for all government activities and generally requires. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant. Accrued payroll includes wages, salaries, commissions, bonuses, and other payroll related expenses that have been earned by a company's employees, but have not yet been paid or recorded in the. It's the nature of the beast that most companies will have accrued payroll and related payroll taxes. Great for creating company payroll simulations, run multiple what if analysis and even estimate.

Payroll Accrual Spreadsheet Employee Template Spreadsheet Template Excel Spreadsheets Templates Payroll Template - For accrual type, you can review:

T Accounts Adjusting Entries Financial Statements And Closing Entries Optional End Of Period Spreadsheet The Unadjusted Trial Balance Of Epicenter Laundry At June 30 20y6 The End Of The Fiscal Year Follows The Data. One of the core concepts of accrual accounting is to recognize expenses in the period that the expense is how to accrue payroll. Governmental accounting standards board statement 34 issued in june 1999 requires accrual accounting for all government activities and generally requires. Determine whether accrued vacation can be. Download a free employee payroll register spreadsheet for microsoft excel®. Instead, they may use a vacation accrual spreadsheet in a program such as excel to track the review your organization's vacation accrual policies. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant. Because few companies pay employees immediately, there is usually a lag time between the end of a pay. Great for creating company payroll simulations, run multiple what if analysis and even estimate. Download professionally developed payroll calculator with employee register and printable paystubs. Under the accruals basis of accounting revenue is recorded when earned and expenses are further details of the accrual to cash method change can be found in our accrual to cash conversion tutorial. Payroll accruals are sums that your business owes to workers for hours they have worked. It's the nature of the beast that most companies will have accrued payroll and related payroll taxes. Why do we accrue payroll expenses? By tara kimball updated august 16, 2019. Accrued payroll includes wages, salaries, commissions, bonuses, and other payroll related expenses that have been earned by a company's employees, but have not yet been paid or recorded in the.

Innovative Business Solutions Ibs Payroll : At The End Of A Fiscal Period A Company Records Adjusting Entries To Recognize Expenses Which Had Been Incurred, But Not Paid For Yet.

Excel Payroll Formulas Includes Free Excel Payroll Template. Payroll accruals are sums that your business owes to workers for hours they have worked. Determine whether accrued vacation can be. One of the core concepts of accrual accounting is to recognize expenses in the period that the expense is how to accrue payroll. Great for creating company payroll simulations, run multiple what if analysis and even estimate. It's the nature of the beast that most companies will have accrued payroll and related payroll taxes. Instead, they may use a vacation accrual spreadsheet in a program such as excel to track the review your organization's vacation accrual policies. Download a free employee payroll register spreadsheet for microsoft excel®. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant. Accrued payroll includes wages, salaries, commissions, bonuses, and other payroll related expenses that have been earned by a company's employees, but have not yet been paid or recorded in the. Download professionally developed payroll calculator with employee register and printable paystubs. Because few companies pay employees immediately, there is usually a lag time between the end of a pay. Why do we accrue payroll expenses? Governmental accounting standards board statement 34 issued in june 1999 requires accrual accounting for all government activities and generally requires. Under the accruals basis of accounting revenue is recorded when earned and expenses are further details of the accrual to cash method change can be found in our accrual to cash conversion tutorial. By tara kimball updated august 16, 2019.

Payroll Accrual Spreadsheet In 2020 Payroll Accrual Payroll Software . The Need To Keep Accurate Payroll Records Is However, An Accurate Pay Stub Will Contain All Of The Above Information, And More Than Half Of The.

15 Free Payroll Templates Smartsheet. Instead, they may use a vacation accrual spreadsheet in a program such as excel to track the review your organization's vacation accrual policies. Great for creating company payroll simulations, run multiple what if analysis and even estimate. Because few companies pay employees immediately, there is usually a lag time between the end of a pay. Under the accruals basis of accounting revenue is recorded when earned and expenses are further details of the accrual to cash method change can be found in our accrual to cash conversion tutorial. Download a free employee payroll register spreadsheet for microsoft excel®. It's the nature of the beast that most companies will have accrued payroll and related payroll taxes. Download professionally developed payroll calculator with employee register and printable paystubs. One of the core concepts of accrual accounting is to recognize expenses in the period that the expense is how to accrue payroll. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant. Why do we accrue payroll expenses? Accrued payroll includes wages, salaries, commissions, bonuses, and other payroll related expenses that have been earned by a company's employees, but have not yet been paid or recorded in the. Governmental accounting standards board statement 34 issued in june 1999 requires accrual accounting for all government activities and generally requires. Determine whether accrued vacation can be. By tara kimball updated august 16, 2019. Payroll accruals are sums that your business owes to workers for hours they have worked.

Wps Template Free Download Writer Presentation Spreadsheet Templates , When Doing Payroll Accruals In The Microsoft Dynamics How Does It Work When You Have More Than 14Days In The Next Month That Pertains To The Pervious Month.

Ledger Accounts Adjusting Entries Financial Statements And Closing Entries Optional Spreadsheet The Unadjusted Trial Balance Of Lakota Freight Co At March 31 2016 The End Of The Year Follows The Data Needed. Why do we accrue payroll expenses? Great for creating company payroll simulations, run multiple what if analysis and even estimate. Download a free employee payroll register spreadsheet for microsoft excel®. Determine whether accrued vacation can be. Governmental accounting standards board statement 34 issued in june 1999 requires accrual accounting for all government activities and generally requires. Instead, they may use a vacation accrual spreadsheet in a program such as excel to track the review your organization's vacation accrual policies. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant. One of the core concepts of accrual accounting is to recognize expenses in the period that the expense is how to accrue payroll. Payroll accruals are sums that your business owes to workers for hours they have worked. Accrued payroll includes wages, salaries, commissions, bonuses, and other payroll related expenses that have been earned by a company's employees, but have not yet been paid or recorded in the. By tara kimball updated august 16, 2019. Download professionally developed payroll calculator with employee register and printable paystubs. It's the nature of the beast that most companies will have accrued payroll and related payroll taxes. Under the accruals basis of accounting revenue is recorded when earned and expenses are further details of the accrual to cash method change can be found in our accrual to cash conversion tutorial. Because few companies pay employees immediately, there is usually a lag time between the end of a pay.

Accrual Versus Cash Basis Accounting Principlesofaccounting Com : Under The Accruals Basis Of Accounting Revenue Is Recorded When Earned And Expenses Are Further Details Of The Accrual To Cash Method Change Can Be Found In Our Accrual To Cash Conversion Tutorial.

Payroll And Accrual Entries The Simple And The Complex Insightfulaccountant Com. Download a free employee payroll register spreadsheet for microsoft excel®. Accrued payroll includes wages, salaries, commissions, bonuses, and other payroll related expenses that have been earned by a company's employees, but have not yet been paid or recorded in the. Download professionally developed payroll calculator with employee register and printable paystubs. Instead, they may use a vacation accrual spreadsheet in a program such as excel to track the review your organization's vacation accrual policies. Under the accruals basis of accounting revenue is recorded when earned and expenses are further details of the accrual to cash method change can be found in our accrual to cash conversion tutorial. It's the nature of the beast that most companies will have accrued payroll and related payroll taxes. Great for creating company payroll simulations, run multiple what if analysis and even estimate. Governmental accounting standards board statement 34 issued in june 1999 requires accrual accounting for all government activities and generally requires. One of the core concepts of accrual accounting is to recognize expenses in the period that the expense is how to accrue payroll. Because few companies pay employees immediately, there is usually a lag time between the end of a pay. By tara kimball updated august 16, 2019. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant. Payroll accruals are sums that your business owes to workers for hours they have worked. Determine whether accrued vacation can be. Why do we accrue payroll expenses?

Payroll Accountant Resume Samples Qwikresume . Along With The Amounts That Each Employee Should Receive For.

Ppp Loan Accounting Creating Journal Entries Ppp Accounting Tips. One of the core concepts of accrual accounting is to recognize expenses in the period that the expense is how to accrue payroll. Download professionally developed payroll calculator with employee register and printable paystubs. Payroll accruals are sums that your business owes to workers for hours they have worked. Governmental accounting standards board statement 34 issued in june 1999 requires accrual accounting for all government activities and generally requires. Instead, they may use a vacation accrual spreadsheet in a program such as excel to track the review your organization's vacation accrual policies. Because few companies pay employees immediately, there is usually a lag time between the end of a pay. Under the accruals basis of accounting revenue is recorded when earned and expenses are further details of the accrual to cash method change can be found in our accrual to cash conversion tutorial. Great for creating company payroll simulations, run multiple what if analysis and even estimate. Download a free employee payroll register spreadsheet for microsoft excel®. Determine whether accrued vacation can be. By tara kimball updated august 16, 2019. Why do we accrue payroll expenses? Accrued payroll includes wages, salaries, commissions, bonuses, and other payroll related expenses that have been earned by a company's employees, but have not yet been paid or recorded in the. It's the nature of the beast that most companies will have accrued payroll and related payroll taxes. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant.

Solved 2 Accrual Basis Please Complete In Spreadsheet Chegg Com : I Am On The Right Track I Think But I Am Messing Up The Formula Somewhere.

Restaurant Resource Group How To Accrue Restaurant Payroll. Governmental accounting standards board statement 34 issued in june 1999 requires accrual accounting for all government activities and generally requires. Instead, they may use a vacation accrual spreadsheet in a program such as excel to track the review your organization's vacation accrual policies. It's the nature of the beast that most companies will have accrued payroll and related payroll taxes. Why do we accrue payroll expenses? Great for creating company payroll simulations, run multiple what if analysis and even estimate. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant. Download a free employee payroll register spreadsheet for microsoft excel®. Under the accruals basis of accounting revenue is recorded when earned and expenses are further details of the accrual to cash method change can be found in our accrual to cash conversion tutorial. Payroll accruals are sums that your business owes to workers for hours they have worked. Determine whether accrued vacation can be. Because few companies pay employees immediately, there is usually a lag time between the end of a pay. By tara kimball updated august 16, 2019. One of the core concepts of accrual accounting is to recognize expenses in the period that the expense is how to accrue payroll. Download professionally developed payroll calculator with employee register and printable paystubs. Accrued payroll includes wages, salaries, commissions, bonuses, and other payroll related expenses that have been earned by a company's employees, but have not yet been paid or recorded in the.

Payroll Spreadsheet Template Excel Or Sample Microsoft Calculator Australia Free Download Sarahdrydenpeterson . By Tara Kimball Updated August 16, 2019.

T Accounts Adjusting Entries Financial Statements And Closing Entries Optional End Of Period Spreadsheet The Unadjusted Trial Balance Of Epicenter Laundry At June 30 20y6 The End Of The Fiscal Year Follows The Data. Under the accruals basis of accounting revenue is recorded when earned and expenses are further details of the accrual to cash method change can be found in our accrual to cash conversion tutorial. Payroll accruals are sums that your business owes to workers for hours they have worked. It's the nature of the beast that most companies will have accrued payroll and related payroll taxes. Why do we accrue payroll expenses? Determine whether accrued vacation can be. Great for creating company payroll simulations, run multiple what if analysis and even estimate. Download professionally developed payroll calculator with employee register and printable paystubs. Governmental accounting standards board statement 34 issued in june 1999 requires accrual accounting for all government activities and generally requires. By tara kimball updated august 16, 2019. Download a free employee payroll register spreadsheet for microsoft excel®. Because few companies pay employees immediately, there is usually a lag time between the end of a pay. Instead, they may use a vacation accrual spreadsheet in a program such as excel to track the review your organization's vacation accrual policies. One of the core concepts of accrual accounting is to recognize expenses in the period that the expense is how to accrue payroll. This employee payroll register spreadsheet was designed for small businesses that choose to use an accountant. Accrued payroll includes wages, salaries, commissions, bonuses, and other payroll related expenses that have been earned by a company's employees, but have not yet been paid or recorded in the.